Future of Energy

Lithium

Lithium is in high demand as we transition to a battery-powered future, yet it's a finite resource.

From 2017 to 2022, the energy sector's demand was a key driver behind a threefold increase in overall demand for lithium, a 70% rise in cobalt demand, and a 40% increase in nickel demand. In 2022, clean energy applications accounted for 56% of total lithium demand1.

Lithium is predominately mined in Latin America and Australia, with China dominating processing. Production of lithium chemicals and products spans countries like China, Japan, and South Korea, making the supply chain global. The U.S., Australia and allied Western nations depend on factors beyond their control for the supply of processed lithium, like global prices, foreign mining and geopolitical factors.

While global lithium reserves theoretically meet rising demand, challenges exist. Few companies can produce high-quality lithium products, and expansion projects may not meet demand swiftly. Moreover, developing lithium mines takes time, with an average of 16.5 years for those starting between 2010 and 2019, however, over 80% of mining projects are often delayed2. Ensuring a stable lithium supply for the growing EV market remains a complex challenge.

The planet possesses sufficient lithium reserves for our foreseeable green-energy requirements. However, the practical process of extracting and utilizing this valuable resource remains a significant challenge.

Lithium and Electric Vehicles

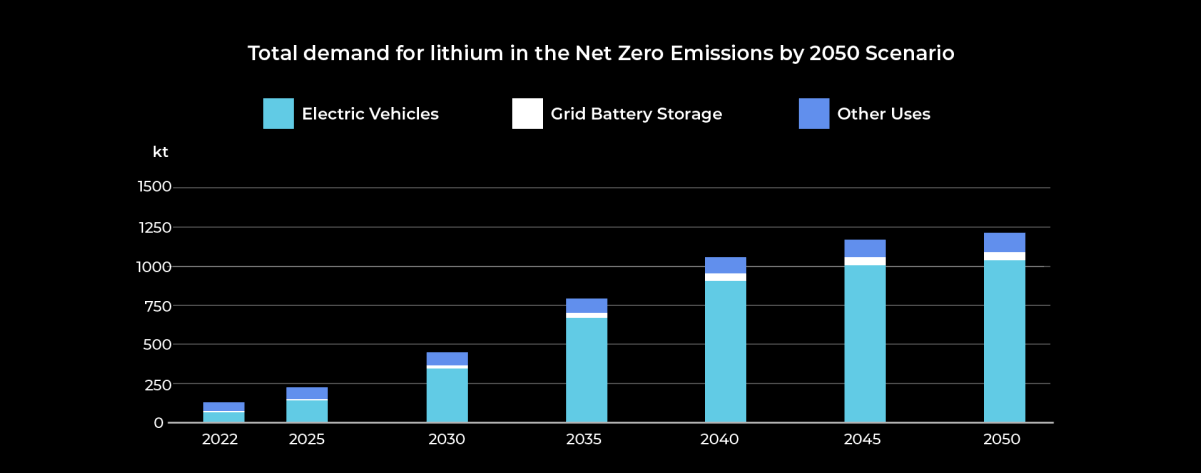

Source: International Energy Agency - Critical Minerals Market Report 2023

In 2022, electric vehicle (EV) sales surged by 60%, surpassing 10 million units, while energy storage systems experienced even more rapid growth with a doubling of capacity additions. Solar PV installations continued breaking records, and wind power was set for a resurgence after two slower years3. This incredible growth has led to a substantial rise in the demand for critical minerals.

China produces over 60% of global lithium, creating a globally reliant supply chain, even if batteries are made in the U.S. The U.S. has committed $2.8 billion in grants to expand electric vehicle battery production, part of it going to major auto suppliers, in an effort to secure domestic supply4. The American Battery Materials Initiative is another effort to ensure a stable supply of critical EV minerals. These initiatives aim to make EVs 50% of U.S. vehicle sales by 2030, spurring domestic manufacturing of EVs, chargers and batteries, aimed at making EVs affordable.

Uranium

Uranium, with atomic number 92 and symbol U, is a silvery-white metallic element with the highest atomic weight among naturally occurring elements. It's found in soil, rock, and water, and is extracted commercially from minerals like uraninite. Discovered in 1789, it was initially used for colorants and later recognized for its radioactive properties. Its energy potential led to its use in nuclear reactors for electricity generation and in various industries globally.

The uranium market, pivotal for nuclear power, is undergoing significant shifts driven by supply-demand dynamics, geopolitics, and changing public attitudes. Governments are enacting pro-nuclear policies to meet net-zero climate targets, boosting demand. Factors such as emerging economies, advanced reactor tech, and small modular reactors are driving market growth. Amidst global efforts for clean energy and decarbonization, nuclear power is gaining recognition for its role, reshaping the uranium market.

During the recent World Climate Action Summit of the 28th Conference of the Parties to the U.N. Framework Convention on Climate Change, more than 20 countries from four continents announced their intent to triple their nuclear power capabilities.

THE ENERGY TRANSITION

Nuclear power can provide a stable source of energy during the transition from fossil fuels to renewable energy sources. In addition, its energy density (the amount of energy it contains per unit of mass) makes it significantly more powerful than other energy fuels1. For example, 1 kilogram of coal has an energy density of 44 megajoules, versus 1 kilogram of uranium (enriched to 3.5%) with an energy density of 3,900,000 megajoules - which would move an average vehicle 1,625 km, versus 18 m for the same vehicle running on crude oil.

Some of the key factors that are seeing nuclear taking a leading role in the energy transition are:

- Nuclear plants offer continuous, reliable baseload power, unlike weather-dependent renewables.

- Nuclear power is low-carbon, emitting no greenhouse gasses.

- Diversifying energy sources enhances security, reducing reliance on fossil fuels and imported energy.

- Ongoing R&D in nuclear technology, like SMRs, boosts safety, waste management, and efficiency, bolstering its role in the energy transition.

URANIUM PRICES

The increased demand for uranium stems from the growing popularity of nuclear energy, especially in countries like China and other emerging markets. Additionally, a significant portion of the uranium supply is situated in geopolitically sensitive regions, further driving up prices as speculative investors capitalize on this trend.

Uranium prices have skyrocketed to peak per-pound prices in January 2024, marking a milestone not seen in more than 15 years. This surge is attributed to a resurgence in nuclear power and disruptions in the supply chain, along with the introduction of physical uranium investment trusts into the spot market. SPROTT, a Canadian asset manager, launched its Physical Uranium Trust in August 2021, holding around 63.6 million pounds of U308.. Similarly, Zuri Invest AG launched its physical uranium investment trust in June 2023.